Introduction

One way for investors to assess whether a prospective investment offers a “good” return is to begin by comparing it to their alternatives, starting with the 10-year Treasury bond rate, or the “risk-free” rate. If an investor buys $100,000 in 10 Year Treasuries, they can say, with relative certainty, that they will earn $1,300 (as of today) per year for the next ten years. The problem with this investment, however, is that the inflation rate is around two percent today. This means that someone who buys a risk-free U.S. Treasury bond at 1.3 percent is actually losing money because the inflation rate is higher than the interest they’ll be earning. This is referred to as a “negative real return”.

Let us assume, then, that investors do not actually want to lose money. This is especially true among investors near or at retirement age, who are looking to invest for cash flow that they can draw upon during their retirement years.

How can investors do better? The answer is to go further out on the risk variable. Most will diversify their portfolio by adding some combination of stocks, bonds, and other fixed-income assets. Most will then redirect 15 to 20 percent of their portfolio into alternative investments, including but not limited to real estate.

Depending on an investor’s risk tolerance, they can invest in real estate opportunities with more or less risk. Investors should expect to be paid incrementally higher returns as the risk profile of a deal increases. This is known as the “risk premium”.

Calculating Risk Premiums

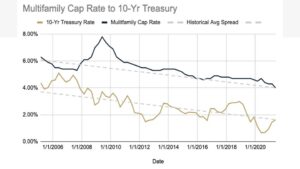

If the U.S. Treasury bond is the risk-free rate, then any investment opportunity with greater risk should generate a risk premium for investors. The graph below shows the relationship between the risk-free rate as measured by the 10-year treasury rate and expected returns from investing in multifamily real estate as measured by the cap rate. The cap rate is the rate of return on an unlevered (i.e.; all cash) investment.

Graph courtesy CrowdStreet

As you can see from the graph above, there is a positive correlation between the 10-year treasury rate and cap rates – as the former goes down, so do the latter. As it turns out, this correlation is not in fact causation as the flow of mortgage funds has been proven to have a more meaningful connection to cap rates than changes in interest rates.

That said, the 10-year treasury is still relevant to an investor’s decision-making as it reflects the risk-free benchmark against which other, riskier alternatives, should be compared. Even so, calculating the risk premium associated with commercial real estate deals is no easy task. There are several variables to consider.

Type of Real Estate Deal

Real estate projects generally fall into four categories: Core, Core-Plus, Value-Add and Opportunistic.

Core properties are considered the safest real estate investments. They are generally stabilized, cash-flowing properties located in primary markets. Core properties include Class A properties that generally draw attention from institutional investors.

“Core Plus” can be thought of as synonymous with “growth and income” in the stock market. These properties have a low to moderate risk profile. Cash flow can often be enhanced with modest physical improvements and/or operational efficiencies. These properties are typically well-located in strong primary and secondary markets and require less physical or operational improvement than value-add projects.

Value-add real estate investments are most akin to “growth” stocks and should be considered to have moderate to high risk, depending on the level of corrective measures needed to stabilize the asset. Value-add strategies can run the gamut, from major interior and exterior renovations of most or all units, to few or no physical upgrades and modest operational improvements. A heavy value-add deal may have little to no cash flow at acquisition (since the income from the property is, by definition, below market at the time of acquisition) but has the potential to produce significantly higher cash flow once improvements have been made. Value-add real estate deals are best suited for adept real estate sponsors who have strong business plans and a history of execution.

Opportunistic deals are the riskiest of all real estate investments. Ground-up development, acquiring an empty building, repositioning a of the property for an alternative use, and land development are all examples of opportunistic investments. These are the considered the most challenging deals and often, do not generate income for three to five years. Opportunistic deals require long-term, patient capital and the returns are often premised more on a long-term capital event (such as a sale) than on near term cash flow.

These ranges make sense. For example, someone who invests in development, where the project will take three years to construct and another year or more to lease up (with no cash flow during the interim), should expect to earn more than someone who invests in a stabilized apartment building needing little to no work in a strong location.

Sponsor Experience

The sponsor’s experience is another factor when calculating the return an investor should expect. Sponsors with a proven track record, with a particular asset class, in that same geography are considered lower-risk than investing with a sponsor who doesn’t have the same experience. Investing with a less experienced operator may also be worthwhile, particularly if they have a solid business plan, but investors would want to account for this inexperience when calculating the return they require.

A sponsor’s ability to underwrite deals accurately is also critically important. An adept sponsor will be able to make realistic projections about current rents, ability to increase rents, return on specific improvements, operational efficiencies and other cost-saving mechanisms. That sponsor may then, for example, assume that, once the property is stabilized, they can increase rents by three percent per year, knowing that some years it may only be two percent and other years it may be four percent. The underwriting should reflect supportable projections of annual growth over the intended holding period.

For example, investing with a sponsor who has 50 years’ experience with core-plus multifamily investing would be considered lower risk than investing with a sponsor who is undertaking a value-add deal for the first time. In short, operator risk is equally as important to consider as project and market risks.

Unanticipated Risks

As is the case with most investments, there is no such thing as an entirely risk-free real estate deal. Even the most well-located, newly constructed, fully leased property carries some degree of risk. For example, an otherwise “perfect” building may be impacted by an unknown or so-called “Black Swan” event – such as a global pandemic or the GFC. This uncertainty can never be fully obviated which raises the question of how investors should underwrite that risk.

Should they require a risk premium to cover the risk of a profound event impacting their investment and, if so, how does one underwrite a risk that is, by definition, unknowable and unforeseeable? Our conclusion is that unless an investor is prepared to forfeit all meaningful returns over the risk free rate, an investor’s best protection is first, to go in with eyes wide open, knowing nothing is 100% certain. Second, this is where the sponsor’s experience is so essential.

A sponsor with experience shepherding their portfolio through good times and bad, and who is judicious with the use of leverage, is an investor’s best insurance against the Black Swan event.

Assessing Your Options and Alternatives

Investing involves making choices. We can take do nothing with our investable capital (e.g.; put it under our mattress). If we wish for the money to grow, we need to find a good balance between risk and reward. The risk-free option, guaranteed by the full faith and credit of the United States Government, isn’t, as it turns out, completely risk free since over time our returns are outpaced by the rate of inflation. That’s why most investors put their capital in a mix of stock, bonds, cash and alternatives, including real estate. How much should be placed in each silo is a function of one’s risk tolerance and time horizon.

When evaluating real estate investments, appropriate returns should be determined based upon first, the alternatives available to the investor and second, the degree of risk associated with the investment in question. That is, if large capitalization U.S. stocks are expected to return 6.6% through 2030 (as Charles Schwab & Co. recently suggested), the investor must first determine whether they think the stock market is fully valued and assess what type of volatility they expect. From that analysis, the investor will have a sense of the risk and the reward associated with investing a given amount of capital in the stock market. Fixed income generally offers offsetting risk to a portfolio but, as we have seen, with interest rates at all-time lows and inflation climbing, the returns are not sufficient to satisfy most investors’ investment objectives. Thus, when evaluating a real estate investment, the investor will naturally compare the returns available from owning property to those presented by the equity and fixed income markets.

Assuming the investor has now decided to deploy their capital in real estate in lieu of stocks or bonds, the same analysis must be made by comparing the various real estate alternatives we have discussed, core, core plus, value add and opportunistic. The higher up the risk curve one goes, the higher the potential returns but also the corresponding risk of loss.

Our conclusion is that the 5%-6% cash flow and 9%-10% + IRR offered by core plus and value add multifamily investments compares favorably to the current return potential of equities and fixed income, balancing nicely both risk and reward. While there are never any guarantees, owning a well-located physical asset in a market with strong employment, balanced supply demand fundamentals and a supportive regulatory environment is a good recipe for growing one’s capital while sleeping well at night.